Table Of Content

If you’re buying a second home or an investment property with a conventional loan, the down payment requirement is usually higher. Second homes typically start at 10 percent, and investment properties can require as much as 15 to 25 percent. That said, the amount you need for a down payment on a house can depend on your creditworthiness and financial situation. Consult with your loan officer to get a better idea of what requirements apply to you.

Student Loan Refinancing

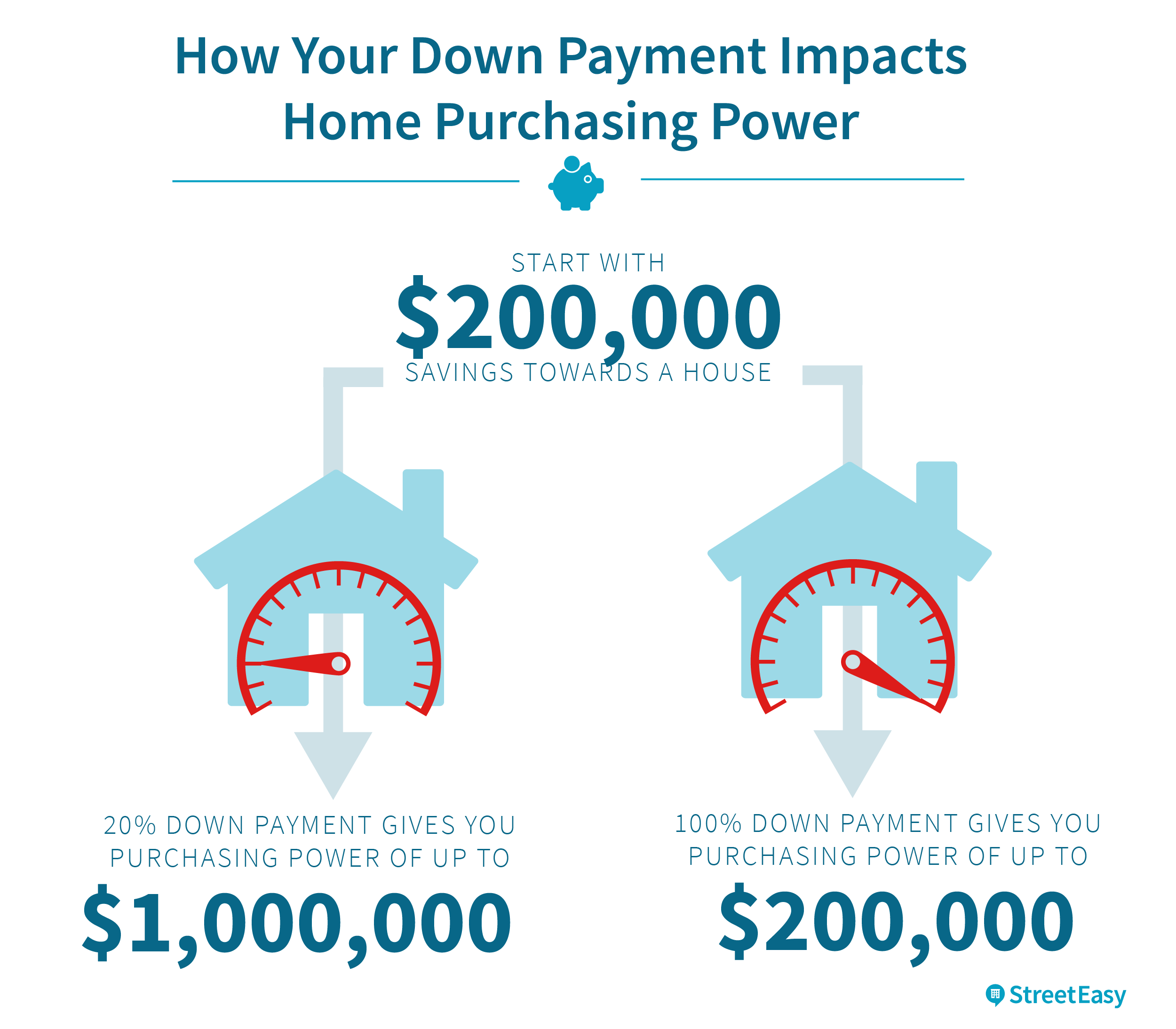

As home prices have risen, so has the percentage of home buyers that make at least a 20% down payment or an all-cash purchase. This could be a function of a more competitive housing market -- a 20% down payment makes it easier to obtain financing while all-cash purchases greatly increase your chances of sealing a deal. You might have heard you’re required to put down 20 percent on a home. In truth, there’s no single figure or percentage for a home down payment; how much to put down on a house depends on the type of loan you get and the mortgage lender’s requirements, among other factors.

How does your credit score impact your down payment?

At the same time, you don’t want your down payment to be so large that it leaves you with too little savings. Most homebuyers also want enough cash after closing to do things like buy new furniture or paint the walls. First-time and repeat buyers may consider government-backed home loans with little or no down payment.

Average Home Down Payment Reached All-Time High in 2023 - CoreLogic

Average Home Down Payment Reached All-Time High in 2023.

Posted: Wed, 27 Mar 2024 07:00:00 GMT [source]

Qualify for a lower interest rate

True, your mortgage rate will also depend on some other factors, like your credit score and monthly debt burden which will include credit card debt along with student loans, personal loans, and auto loans. Either you can prompt your lender to stop charging it when your loan balance reaches 80% of your home’s market value, or you can refinance out of mortgage insurance on an FHA loan. This means they can use equity — rather than depending on their savings account — to make their down payment. They’re also less likely to have obligations like student loan debt and car payments.

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

First-time homebuyer down payment assistance programs

Preapprovals are not available on all products and may expire after 90 days. While it is possible to afford the minimum down payment, making a larger down payment has numerous advantages. Here are a few reasons why you might consider putting down a larger deposit on your future property. The Author and/or The Motley Fool may have an interest in companies mentioned.

Three percent down would be $24,173; 10% down, $80,576; and 20%, $161,155. You can look into the cost of living by state for an overview and then find the median home value in a particular state at a given point in time and estimate your down payment. A fortunate 25% of younger Millennial homebuyers received down payment help from a friend or relative. You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering.

Checking Accounts

Average Mortgage Payment by State, City, and Year - Business Insider

Average Mortgage Payment by State, City, and Year.

Posted: Tue, 02 Jan 2024 08:00:00 GMT [source]

In a new survey, nearly 2 out of every 5 homeowners say they couldn't afford their house at today's prices. And while this might be a good thing for owners for whom real estate is a store of value, it also speaks to the state of the market that buyers now find themselves in. Exactly how much you qualify for will depend on your individual circumstances, including credit score, current interest rates and how much you’ll have in savings after you buy a home.

What if I can’t afford the down payment for the house I want to buy?

The average down payment nationwide was 13% in 2022, according to the NAR. Given that the most recent Spring 2023 data showed a median price of $388,800 for home sales, that would mean most people are plunking down about $50,544 for a down payment. You may have heard that 20% is the ideal down payment, but that doesn’t mean you must pony up that amount to become a homeowner.

The one requirement is that the funds need to be properly documented. The lender needs to be able to see where they came from, and they need a letter stating the donor won’t ask for repayment. In all but a few areas, you’re likely to see your home’s value grow each year..

These are often city- or state-based, and they usually provide no more than the bare minimum you need to qualify for a loan, such as 3%. The Community Seconds and Affordable Seconds programs are two ways to buy a home with 0% down. Check out our list of first-time home buyer programs, grants and mortgage loan options to see how you qualify. Explore different home-buying costs, like the down payment and closing costs, to determine how much money you need to buy a house.

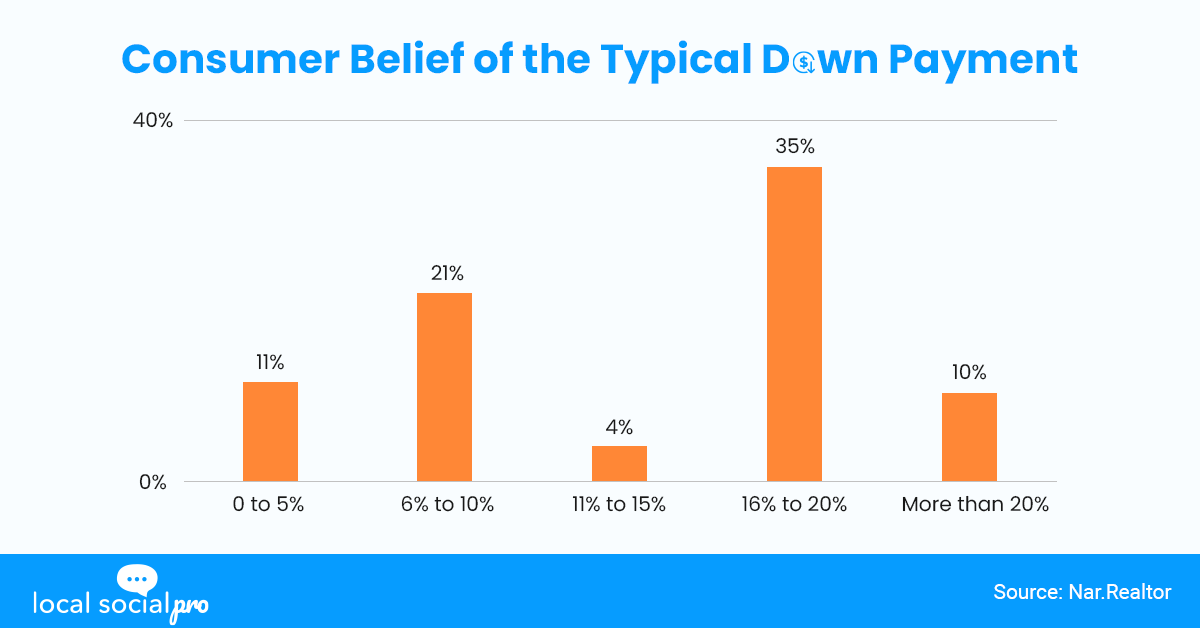

Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. Why do many consumers believe the typical down payment on a house is 20%? This common misconception may be due to something called private mortgage insurance (PMI). 6% of first-time buyers and 34% of non-first-time buyers paid all cash in April 2021. In April 2019, the number of non-first-time buyers who made an all-cash purchase was 26.3%. The first-time buyer all-cash purchase percentage has not changed since April 2018.

In truth, the average down payment on a house is considerably smaller. Currently, the median down payment on a house is 13%, according to data from the National Association of Realtors® (NAR). If you can't afford the down payment on a home you want, you may want to continue saving until you build up your savings enough to qualify. If you have at least 3% or 3.5% to put down, however, you may be able to qualify for a conventional mortgage or a FHA loan.

Amy Fontinelle is a freelance writer, researcher and editor who brings a journalistic approach to personal finance content. Since 2004, she has worked with lenders, real estate agents, consultants, financial advisors, family offices, wealth managers, insurance companies, payment companies and leading personal finance websites. Amy also has extensive experience editing academic papers and articles by professional economists, including eight years as the production manager of an economics journal. Get Forbes Advisor’s ratings of the best mortgage lenders, advice on where to find the lowest mortgage or refinance rates, and other tips for buying and selling real estate. The minimum amount you can put down will depend on the type of mortgage you get.

You can save thousands of dollars over time by reducing the amount of money you borrow and the interest you pay on the mortgage loan. It’s essential, however, to analyze your financial situation to determine whether a large down payment is a good option for you. Waiting until you have enough savings for a large down payment could lead you to spend more money in the meantime.

On the other end of the spectrum, home buyers in places like Fresno and San Bernardino could probably get by with a much smaller down payment. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market.

No comments:

Post a Comment